Remembering Five Rivers in Your Estate Planning

Remembering Five Rivers Conservation Trust in your estate planning supports our important work and ensures that the lands we all love are conserved in perpetuity. We are deeply grateful for your consideration.

There are many ways that a legacy gift can support Five Rivers Conservation Trust. Through your generosity, you can help connect people to nature and conserve land in our region forever.

The following are some of the ways you might choose to support Five Rivers through your estate planning. Each person’s estate planning considerations are unique, so we encourage you to consult with your legal and financial advisors. For more detailed information about any of the following planned giving opportunities, please call Liz Short, Executive Director, at 603-225-7225 x203 or email her at liz@5rct.org.

- Gift from a Will, Trust or Residuary Estate. The simplest and most common way to include the Five Rivers Conservation Trust in estate planning is by making a charitable provision in your will or trust.

This kind of charitable bequest can take several forms. It can be a designated dollar amount, or a percentage of the estate, or “the residual” – that is, the amount remaining in the estate after all other obligations and payments have been made.

If you are interested in leaving a gift to the Five Rivers Conservation Trust in your will or trust, please make sure to speak with your attorney. We encourage you to provide your attorney with this sample language:

“I hereby give and bequeath __________________ (dollar amount, or percentage of my estate, or residual of my estate after other bequests) to the Five Rivers Conservation Trust, 10 Ferry Street, Suite 311-A, Concord, New Hampshire 03301, for its general purposes.” - Gift from a Retirement Plan or IRA. You can designate Five Rivers Conservation Trust as a beneficiary of one or more of your retirement investment funds or IRA accounts. Many donors find this the most tax-advantaged asset to leave to charity, because, while your heirs would be liable for deferred income tax upon inheriting traditional retirement funds, charitable organizations like Five Rivers would not need to pay any income tax.

- Gift of Life Insurance. Many donors find it simple to name Five Rivers the beneficiary of a fully-paid life-insurance policy you and your family no longer need.

- Distribution from a Charitable Remainder Trust. You may be contemplating establishing a Charitable Remainder Trust, where you will receive income for life, and then the funds in the trust are distributed to charitable organizations. Please consider including Five Rivers as a charitable beneficiary!

- Donate the principal of your Donor Advised Fund. If you have a donor-advised fund (DAF), consider contacting your DAF sponsor and instructing that any funds remaining in your donor-advised fund be distributed to Five Rivers Conservation Trust and other charitable organizations.

- Gift from a Bank or Brokerage Account. It is possible to designate Five Rivers the beneficiary of bank accounts and certain investment accounts as the “payable on death” (POD) beneficiary.

If you choose to support Five Rivers through your estate planning, please feel free to notify us of your intent by contacting Liz Short, Executive Director. Five Rivers Conservation Trust is a 501(c)(3) nonprofit charitable organization, Federal Tax ID 02-0427594.

Make a Donation

Join Us In Protecting the Places You Love!

“There was a lot of laughter!”

That was our consultant Lisa’s reaction after meeting people who care about Five Rivers’ work. It’s no surprise — joy, connection, and gratitude are at the heart of the Five Rivers community.

That spirit fuels everything we do: love for the land, passion for the outdoors, and a shared vision for a future where New Hampshire’s special places remain protected for generations.

Thanks to supporters like you, Five Rivers has conserved over 6,400 acres across 89 properties in 17 towns — farmland, forests, waterways, and recreation areas that make our region a wonderful place to live.

But with every acre conserved comes lasting responsibility. We are seeing rising needs and costs associated with our stewardship obligations. To ensure the integrity of the lands we protect forever, your support is more important than ever.

If you can, please consider a special or increased gift this year to help meet growing stewardship needs.

For information on donating stock or contributing from your retirement accounts, click here. For information on remembering Five Rivers in your estate planning, click here.

Five Rivers Conservation Trust is a 501(c)(3) nonprofit charitable organization, Federal Tax ID 02-0427594. Donations made to Five Rivers are tax-deductible to the extent allowed by law.

Your generosity keeps this joyful work going strong.

Become a Business Sponsor

Central New Hampshire is an incredible place to live, work, and visit—with local farmstands, miles of recreational trails, and healthy rivers for fishing, kayaking, and more. For 35 years, Five Rivers Conservation Trust has been working with communities and landowners to ensure a thriving future for the landscapes and waterways, adding richness to the lives of residents and visitors alike.

Please consider becoming a Business Sponsor with an annual gift of $500 or more to help support Five Rivers’ important work. As a local business leader, you care about the well-being of your community members and want to see the Capital Region flourish.

Your sponsorship will reach our expanding pool of social media and e-newsletter followers, event participants, volunteers, and annual supporters while showcasing your business’ values. Most importantly, your sponsorship will provide the resources needed to help our lean organization conserve new lands, steward the 6,400 acres across 89 properties already entrusted to us, and tackle the opportunities and challenges ahead.

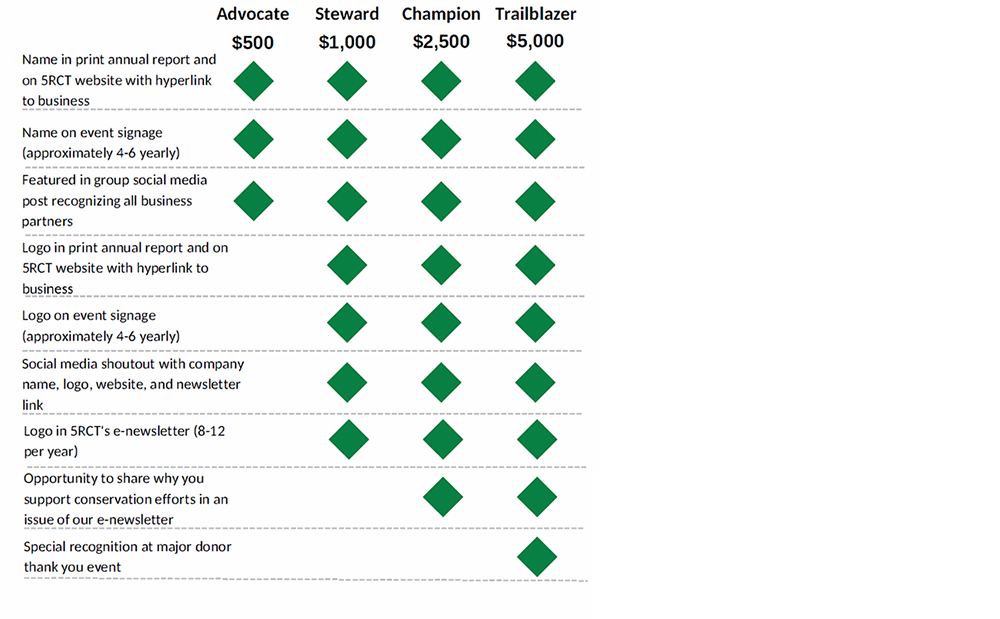

BUSINESS SPONSORSHIP LEVELS

You may become a Five Rivers business sponsor by completing the online form below. If you prefer, you may download, complete, and mail this business sponsorship form (PDF format). If you have questions or would like more information, please reach out to info@5rct.org or Liz Short (liz@5rct.org), Executive Director.

Five Rivers Conservation Trust is a 501(c)(3) nonprofit charitable organization, Federal Tax ID 02-0427594.

Gifts of Stock or IRA Distribution

QUALIFIED CHARITABLE DISTRIBUTION (QCD) FROM AN IRA

If you are 73 or older, you can help satisfy your annual Required Minimum Distribution by having your custodian send gifts to Five Rivers directly from your retirement accounts.

GIVE APPRECIATED STOCKS, BONDS, OR MUTUAL FUNDS

Gifts of appreciated securities are another popular form of gift and often provide a donor with the opportunity to avoid capital gains while also providing a charitable deduction for the fair market value of the donation.

Please contact Executive Director Liz Short for more information at liz@5rct.org or 603-225-7225. We recommend that you consult your professional advisor to make sure these options are right for your financial situation.

Five Rivers Conservation Trust is a 501(c)(3) nonprofit charitable organization, Federal Tax ID 02-0427594.

Join Our Conservation Leaders Society

Conservation Leaders Society members represent the most generous members of our community. We gratefully welcome into the Society all donors who contribute $1,500 or more each year. We are also inviting all Conservation Leaders to consider giving at one of the higher levels within the Society – $2,500, $5,000, or even higher. And do know that, whatever you can donate, we are deeply appreciative.

Members of the Conservation Leaders Society are individuals who are committed to sustaining healthy communities by connecting people to nature and conserving land forever. To maintain our momentum and keep Five Rivers in a position to respond to community needs, we depend on supporters like you.

Over the years, Five Rivers Conservation Trust has permanently protected more than 6,000 acres of land across 89 properties in 17 New Hampshire towns. These conserved lands include productive farmland, forests, water resources, and places for public recreation. We’re currently advancing three board-approved conservation projects, with the potential to close by the end of this year. And there are many more important projects waiting in our pipeline!

Your donation helps support every aspect of our work—from securing new conservation lands to caring for the properties we’ve already protected. In order to keep up with the growing demands for conservation, Five Rivers relies on members of the Conservation Leaders Society.

For information on donating stock or contributing from your retirement accounts, click here. For information on remembering Five Rivers in your estate planning, click here. Your Conservation Leaders Society contribution is tax-deductible. Five Rivers Conservation Trust is a 501(c)(3) nonprofit charitable organization, Federal Tax ID 02-0427594. If you have questions, please contact us at 603-225-7225 or info@5rct.org. Thank you for your support!